298. RESERVE GROWTH

There was a bit of confusion regarding the previous post (#297), so let me shed some light with a simple calculation.

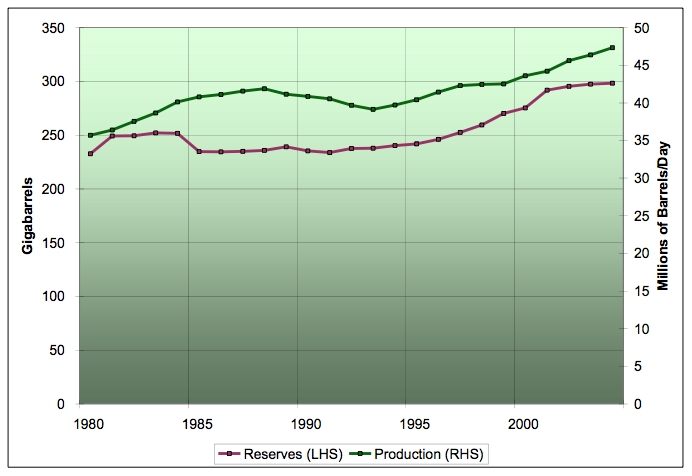

Turning again to the BP Statistical Review, we obtain the following figures:

World oil reserves in 1980: 667Gb

World oil reserves in 2004: 1189Gb

Word oil production 1980-2004: 609Gb

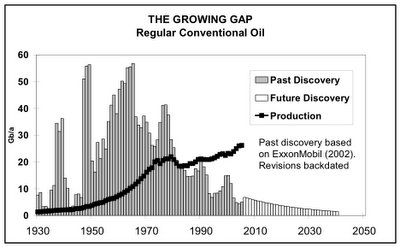

Now, I have also previously transcribed Colin Campbell's "Growing Gap" graph of discovery (Feb. 2006 version):

From this graph, we can derive total world discovery for the period 1980-2004:

World oil discovery 1980-2004: 339Gb

So let's do the calculation. We start in 1980 with 667Gb of reserves in the world. Over the course of 24 years (1980-2004), we pump out 609Gb of that, leaving us with 58Gb. To that we add the amount discovered in the period 1980-2004 (i.e. 339Gb), giving us a total of 397Gb in 2004.

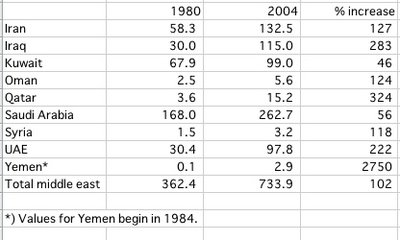

Clearly, something has gone seriously haywire because the actual reserves in 2004 are 1189Gb, i.e. 792Gb more than we should have if discovery is the only way to increase reserves. That's a massive discrepancy roughly equal to 4 Saudi Arabias, or 66 Prudhoe Bays. So, all you peak oil geniuses out there, where did it come from? It could not have come from discovery.

Spurious additions to OPEC reserves won't explain it. OPEC reserves only increased by 456Gb from 1980 to 2004, so that still leaves us with 336Gb unaccounted for. That's 28 Prudhoe Bays which somehow got added to world reserves between 1980-2004, without being discovered. Where did that 336Gb come from?

We saw this same phenomenon at work in 239. GHAWAR NOW EMPTY. We have already pumped more oil out of Ghawar than the 1975 estimate of Ghawar's ultimately recoverable reserves (URR), according to data from Matt Simmons himself. So how do you explain that? Did the reserves in Ghawar somehow grow without any new discovery taking place? It definitely seems that they did. But if the reserves of Ghawar can grow without new discovery, why can't other OPEC oil fields grow in the same way? Why is it so outrageous to think that OPEC reserves can grow given that we are forced by the facts (as given by Matt Simmons) to admit that the reserves in Ghawar have grown?

Now, it's true that OPEC updates its reserves figures in an unorthodox way, and the additions seem fishy on the face of it. Nevertheless, it is silly to think that OPEC reserves do not grow, even though non-OPEC reserves world-wide do so. If OPEC reserves do not grow, then the reserves of Ghawar have not grown since 1975. Ghawar is now completely pumped out, as I have previously shown, and we are all already dead from the cataclysmic repercussions of that event.