372. SPECULATION FIGHT: JUST WARMING UP

Recently, the CFTC released an Interim Report arguing that speculation has not systematically driven the rise in crude oil prices. In the Oil Drum camp, this was greeted with a wave of high-fives and honking of party horns, as if it marked the end of the speculation debate. The debate has not ended, however. In fact, it has hardly begun, and will continue and intensify for a number of powerful, common-sense reasons:

1) The speculation issue is not limited to crude oil. It involves agricultural futures markets as well. Farmers and grain elevators are facing punishing margin calls, inability to market their crops, inability to capture futures prices, and failure of futures to converge with cash prices Source1, Source2, Source3, Source4.

Here's Tom Buis, president of the National Farmers Union: "There's something wrong. I have doubts whether the CFTC is the place to rectify the problem - it may warrant congressional intervention. When regulators say a problem doesn't exist, despite the fact farmers cannot market their commodities that sounds an alarm." Source

These problems in agricultural markets have become so bad that the CFTC has been forced to call hearings in April and July to deal with irate farmers, grain dealers etc. And the people complaining are not denialist newbies grasping at the straw of "speculation" to avoid facing peak oil. They are long-time futures market insiders -- people who've been in the market for decades. They say the problem is a massive influx of speculators from Wall Street. Should we tell the farmers to shut up because the speculation debate is over? Tell them they're in denial? That it's all in their heads? Obviously not. Rampant commodity speculation is causing severe problems in a broad range of markets, and common sense says we should dig down and get to the bottom of it. There is no reason whatsoever for allowing Wall Street to turn critical markets for food and energy into casinos for rich people.

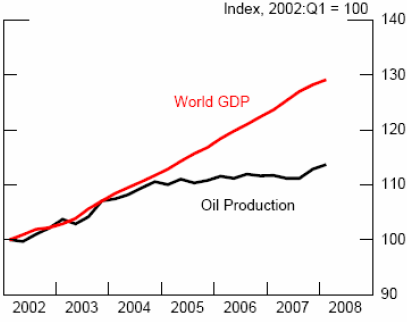

2) The issue isn't: did speculation singlehandedly cause the run up in oil from $10 in 1998 to $145 in 2008? Clearly, supply and demand are the foundation of the trend. Everyone agrees with that. The issue is: how much cheaper can oil (and other commodities) be if index speculators are forced to liquidate their rolling long positions? Even a $10 or $20 benefit could be worthwhile.

3) Here's the Interim Report on the topic of index investors:

Commodity index funds have grown significantly during the past few years, bringing significant long positions to commodity markets. In the futures markets, these funds have typically been long-only funds, buying near-term futures contracts and rolling their positions into more distant months as the delivery month approaches. Commodity index funds are often utilized by pension funds and other large institutions that seek commodity exposure to diversify existing portfolios of stocks and bonds and this exposure is provided by swap dealers. Although commodity swap dealers' gross positions have grown significantly, swap dealers' net positions decreased substantially between 2006 and June 2008. (Figure 12) This suggests that flows from commodity index funds have been offset by other swap dealer activity and thus have not necessarily contributed to the recent price increases in crude oil.So the argument is this: The long positions held by index investors are being offset by the short positions of someone else in the market and thus have "not necessarily" contributed to rising prices.

Across all maturities, the aggregate position of swap dealers in WTI crude oil futures contracts was only marginally net long as of the end of June 2008 and was net short on average during the first five months of 2008. This means that swap dealers' futures positions, on balance, were poised to benefit more from a fall in crude oil prices than from a rise in crude oil prices.

(P. 23-24)

But if you look at it that way, every participant in the futures market is being offset by his or her counterparty, so no one does/can contribute to a price rise or fall. It's very much like saying that a bubble can't form in the stock market because for every buyer of a stock, there must be a seller, and thus the downward pressure of each seller cancels out the upward pressure of each buyer. In short, it's a piece of sophistry.

As I said above, the important question is: how much cheaper will oil be if index speculators are forced to liquidate their rolling long positions? As I showed in 360. WHEN INDEX SPECULATORS SELL, the experiment has already been done once, and the results were very interesting. In 2006, index speculators were forced to sell $6 billion worth of rolling long positions in gasoline due to a rejuggling of the composition of the GSCI, and gasoline prices fell $0.82 in four weeks.

The simplest way of settling this issue is to take a pass on the spin and Wall Street smoke screens, and do the test empirically. Force the index longs to sell without rolling, and see what happens. The CFTC says index longs aren't affecting prices at all, so nothing will happen. What have we got to lose?

4) It's interesting how a generally leftish website like The Oil Drum immediately pimps for banks, hedgefunds, speculators and other Wall Street interests on the speculation issue. In a way, I think they see speculation as a sort of stealth carbon tax... "What's wrong with index funds and other long-only investors keeping oil prices at an elevated level? That's exactly what we wanted to do anyway! It's like a carbon tax, only better, because the NASCAR stooges can't object to it."

Another way to look at it, I suppose, is that commodity speculation is the last hurrah for the banks. You know the swap dealers we keep hearing about? It turns out that these are the same large banks who brought you the mortgage crisis. They're like vampires that have to suck the blood of some financial bubble, and at this point, their commodities businesses are the only profit center left standing. This is likely a major reason why the Bush administration is so keen to paper over the issue, and let the commodity speculation fest continue.

5) Many defenders of speculation say something like this: "The people who are investing long in oil and other commodities are only trying to preserve the value of their money against inflation. You can't blame them." And that's all true. However, if it's okay for one person to change their money into commodities to protect it against inflation, then surely it's okay for everybody to simultaneously change all of their money into commodities. We can't blame them right?

Unfortunately, that scenario isn't an investment strategy anymore; it's a full-scale loss of confidence in paper currency, which would be an unmitigated disaster for everyone. We simply can't have everyone changing their money into wheat or petroleum products and holding it as a money surrogate.

If it's not okay for everybody, then it shouldn't be okay for a privileged elite.

6) Eliminating index speculators from commodity markets is not an "anti-market" move. It's simply a restoration of futures markets to the smoothly functioning Ronald-Reagan-approved free-market state they existed in for decades before the index fund pig wallow of the 2000s.

7) Some people claim that futures markets are just a form of gambling that doesn't actually affect real world prices -- rather like people betting on a basketball game who don't affect the outcome. If that's the case, there's really no good grounds for not regulating speculation. Governments routinely regulate gambling.

Further reading:

Commodity Speculation Fight Only Just Beginning

The industrialised world, which has the power to substantially reduce commodity speculation if it chooses to use it, is ultimately disadvantaged by high commodity prices. If the blow represented by rising demand and severely constrained supply can be softened then it is not hard to argue that it should be. Free market diehards may disagree, but sometimes free market principles have to be sacrificed for the sake of realpolitik, or maybe just commonsense.

CFTC Official Seeks Independent Study On Speculators In Markets

A Commodity Futures Trading Commission official said Tuesday that billions of dollars in speculative investment are having an impact on futures markets, but Commissioner Bart Chilton is calling for an independent study to determine just how much.

Chilton said Bush administration officials have continuously downplayed the role of speculators on oil and agricultural futures but that an independent evaluation is needed to take political spin out of the assessment.

"I've got to believe that $250 billion (in new speculative investment over recent years) is having some ... impact" on futures, Chilton said in a written statement.

by JD